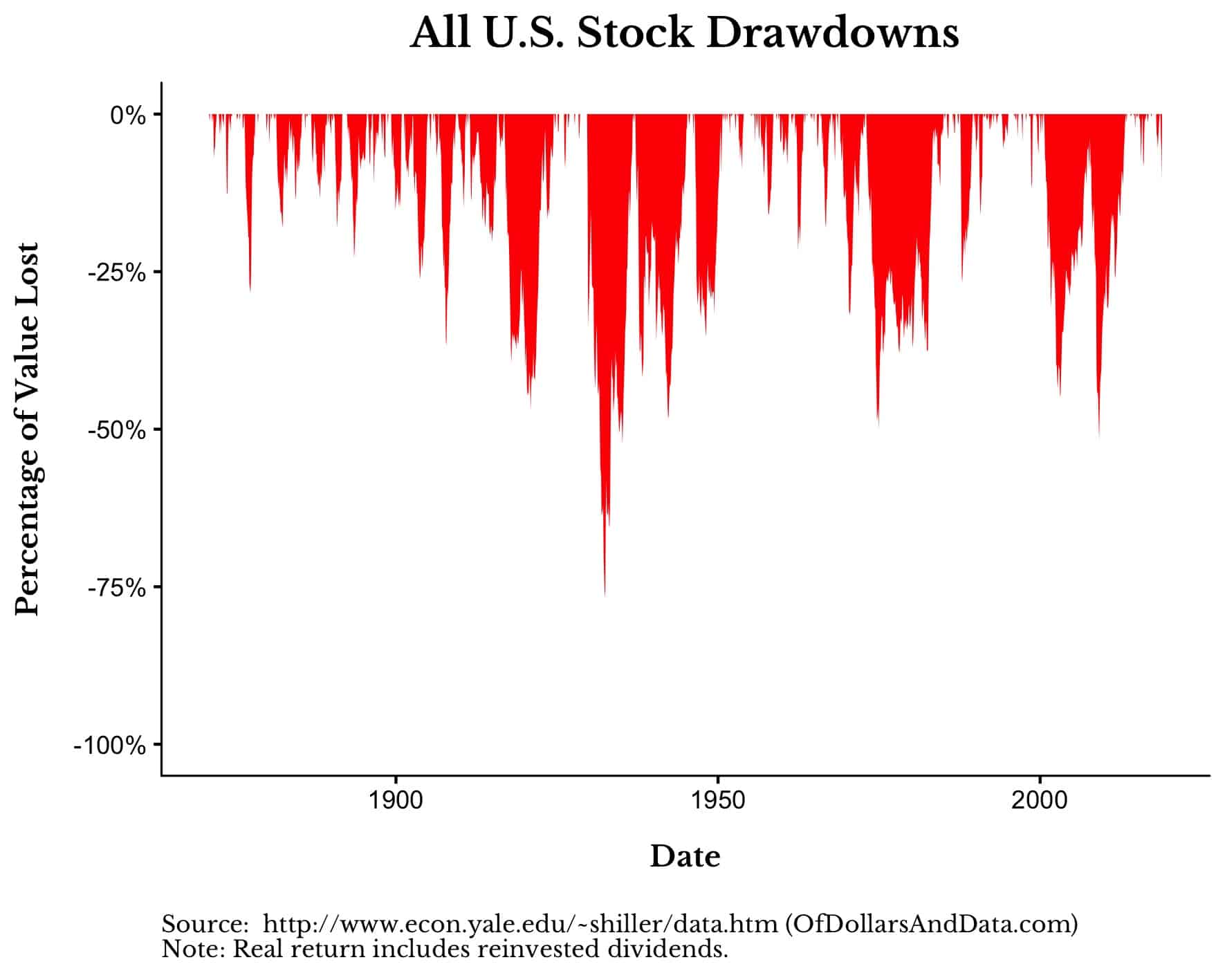

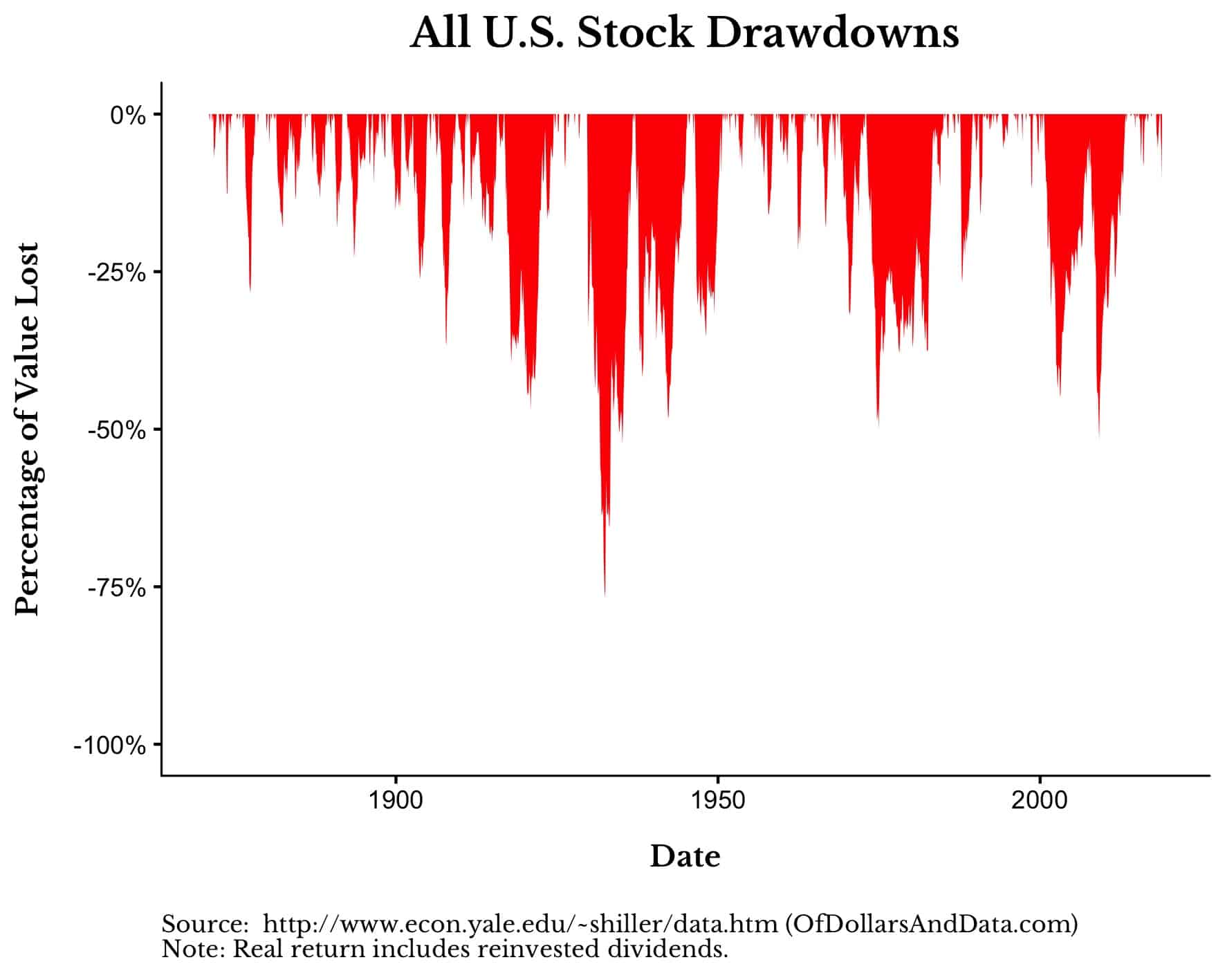

Video: CFD (Contracts for Difference) Essentials. Measuring fair value in uncertain times. What happens next? The DesTek Fund will have a subsequent closing with new investors.Ĭlick here for the next post, Subsequent Closings & Equalisation. We’ve shown the commitment amounts, the initial closing at 31st December and the first drawdown at 31st January. So the uncalled capital after Drawdown A is $355 million. 1) Central banks have helped push equity valuations to record highs. It states that you can comfortably withdraw 4 of your savings in your first year. An ounce of prevention is worth a pound of cure Benjamin Franklin. So after this Drawdown A, what is the situation at fund level? The total commitment amount is $405 million, of which $50 million has been paid in by these investors. The 4 rule is a common rule of thumb in retirement planning to help you avoid running out of money in retirement. This demands that the LPs pay the fund a certain amount of capital on or before a certain date, in this case, 31st January. The first-period investment drawdown of 27 is larger than the second-period investment drawdown of 20, even though the actual dollar amount of the drawdown (3,000) is the same. (1 min) If you hear the term ‘drawdown’ applied to your investments, it means you lost money. It is an important risk factor for investors to consider, becoming more important in asset management in recent years. The fund notifies the investors by way of a Capital Call Notice or Drawdown Notice issued to the LPs (sample extract shown below). A drawdown is an investment term that refers to the decline in value of a single investment or an investment portfolio from a relative peak value to a relative trough. So, each of the 5 LPs he must pay 19.75% of $50 million, $9,876,543, on or before 31st January 2014. This money will be called from investors in proportion to their % ownership based on committed capital. There are several types of equity drawdowns including a maximum drawdown and a period drawdown. We’ll refer to this first drawdown as Drawdown A. A drawdown is a contraction in the value of a portfolio. This capital will finance portfolio investments or be used to pay fund expenses including management fee. In this case, there’s a 73.9 chance of seeing a decline of greater than 10 in any year. Our data set, which begins with the inception of the S&P 500, is based on 70 years of data.

Then the GP decided the fund needed $50 million cash by 31st January 2014. Lynch’s probability of a 10 or greater drawdown was based on a mixture of indices 1 that included 95 years of data. The DesTek Fund had an initial closing date of 31st December 2013 and total committed capital at that date was $405 million. This post introduces the Drawdown, also known as a Capital Call.

Drawdown meaning in stock market series#

This is the third in a series of posts on private equity fund accounting.įor the second post, Commitments & Closings, click here. Private Equity Fund Accounting - Drawdowns

0 kommentar(er)

0 kommentar(er)